Notes on ProCore's S-1

Intro

ProCore just filed their paperwork with the SEC to go public.

The company is a promising vertical SAAS player with a lot of runaway to grow. These are my notes from reading their S-1 filing.

Company Background

ProCore is a construction software company, focused on enabling collaboration between the various stakeholders of a typical construction project. (owners, architects, general contractors, specialty contractors, engineers)

CEO and founder Craig Courtemanche started the company in 2002, scratching his own itch when he was renovating his house in Santa Barbara.

While Santa Barbara is not a hotbed for tech startups, they have plenty of Bay Area and Los Angeles refugees looking for a quieter lifestyle. According to a talk that he gave in 2015, current company president and early investor Steve Zahm found out about ProCore when he moved to Santa Barbaraafter selling his own company DigitalThink for $120 million.

It took the company 7 years of R&D before getting traction. It’s hard to get internet in construction sites back in 2002 when ProCore started, and initially Courtemanche and Zahm had a hard time raising money. When the 2008 crisis hit, Courtemanche mortgaged his house, and along with Zahm, cut his salary to zero. All but 5 employees were laid off.

The overall construction and housing market slowly improved, and the introduction of the iPad and the increasing ubiquity of the internet helped the company gain traction.

They were finally able to raise more money in 2014 (12 years after the company was founded) when their growth started to accelerate. Since then the company has experienced strong growth and have been able to raise a significant warchest.

The now 1,900-strong company has filed to go public in February 2020, and will trade on the NYSE under the symbol “PCOR”.

Platform Overview

ProCore started as a collaboration product for construction stakeholders, but has since gone on to introduce additional services for digitizing the various steps of the construction lifecycle.

The company offers 13 different products/services today, but many of their products are new. For the majority of their history they only offered one product. They have rapidly expanded their product suite from four products in 2017 to the 13 today.

The platform is increasingly becoming the system of record for customer projects, which helps increase switching costs for customers.

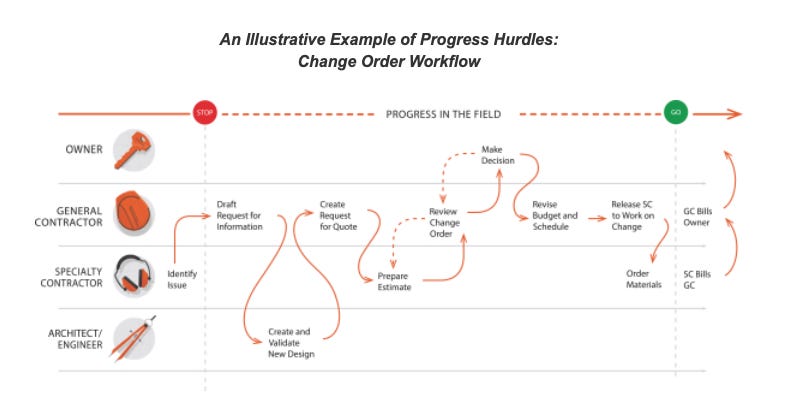

Construction workflows are complex because they involve a lot of back and forth between stakeholders. An example workflow for a change request was included in the S-1:

The company has also introduced an app store, which currently has 180 3rd party apps. These apps include functionality for analytics, accounting, scheduling, CRM, etc. As of the end of 2019, 72% of customers use at least one integration, and 40% use 2 or more.

In 2019, the average length of a construction project was ~20 months, and on average each customer invited over 170 project participants. These project participants are not all paying customers, in 2019, the company estimates that 60% out of the 1.3 million users who logged in were collaborators.

ProCore believes that these collaborators can become potential paying customers of the platform in the future, though they didn’t provide any numbers around this conversion rate.

ProCore runs on AWS. I couldn’t find more details about how much they spend on the cloud platform.

The company has also been increasing the number of add-on services. It started 2017 with 4 products, and has since added 3 products in 2018, and 4 products in 2019.

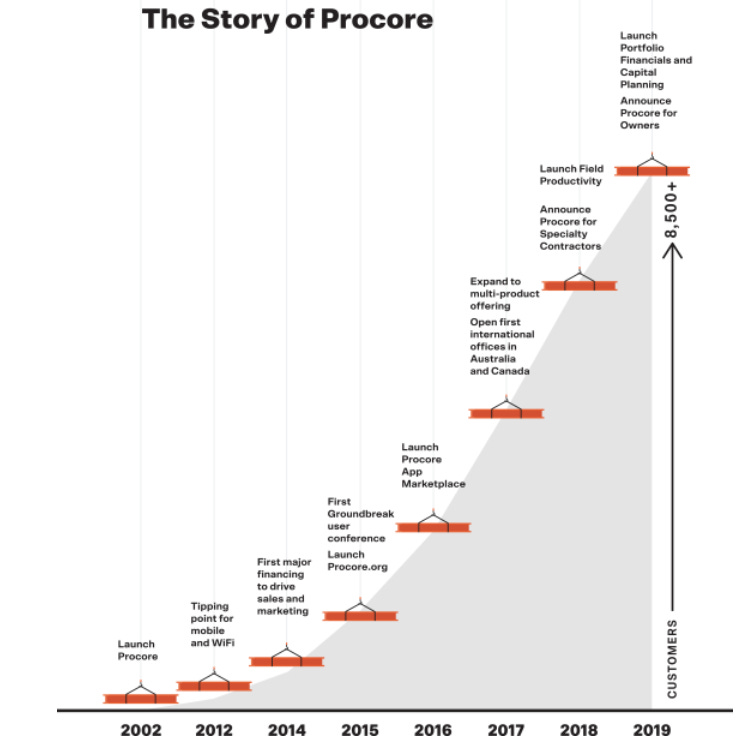

The S-1 contains a chart of product introductions superimposed on customer growth numbers.

Since Procore doesn’t charge for additional users and projects, they can only increase ARR/customer with additional product subscriptions.

Sales and customer acquisition

Procore sells through a direct sales team that is segmented by customer size. They utilize an inside sales model for smaller customers, and a field sales team for larger ones. Sales commissions are amortized on a straight-line basis over 4 years.

Sales efficiency (implied months to pay back)

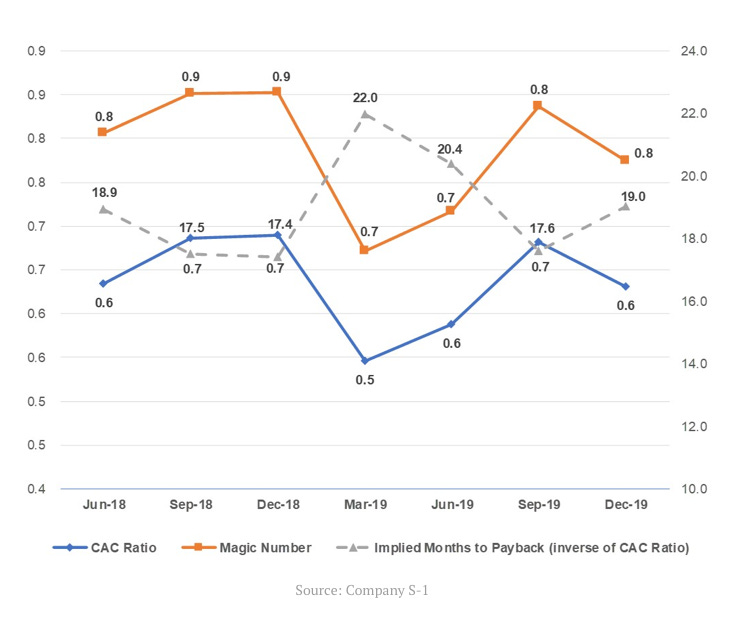

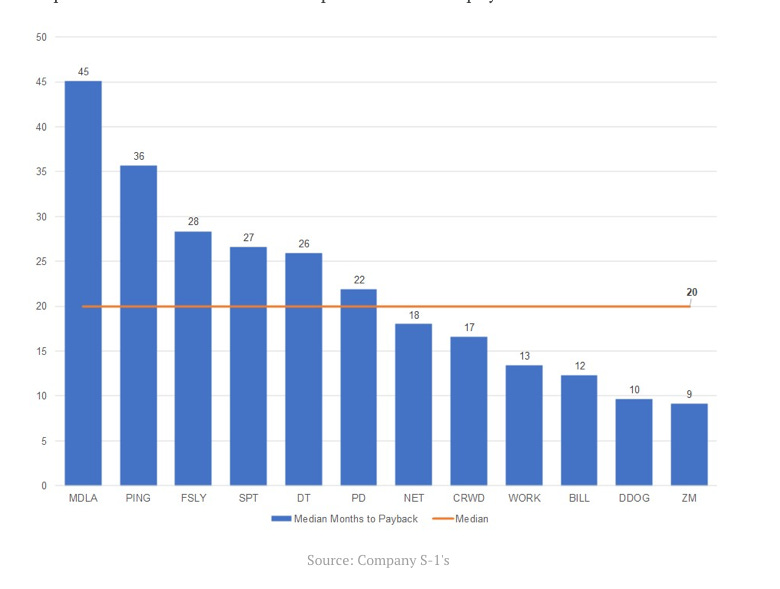

ProCore makes back it’s customer acquisition cost in 18-19 months. (The public company SAAS median benchmark is 20 months)

ProCore’s CAC and Sales Efficiency

Comparables for Implied Months to Pay Back

Industry landscape

The construction industry represented 13% of global GDP and ~7% of the workforce in 2017. (from ProCore’s S-1) Much of the industry still relies on paper, email, and fax.

Rivals

The strongest competitor is probably AutoDesk. (the new-ish CEO is focusing on proptech) AutoDesk acquired PlanGrid (a YC company), Assemble Systems, and BuildingConnected.

AutoDesk’s AEC (Architecture, Engineering, and Construction) vertical earned $358M in the last quarter of 2019, but their current product mix is not quite comparable to ProCore’s.

From AutoDesk’s 10-Q 2019 (Ending 10/2019):

Financials

The company’s revenue mainly comes from subscriptions to its software. The subscriptions are on a fixed-fee basis. (based on number of products used and the fixed aggregate dollar volum of construction work contracted to run on the platform) ProCore does not charge per-seat or per-project.

TAM

The company estimates a ~$9.4B TAM for their current products, based on their median ARR and an estimate of total addressable customers.

Based on this report, ProCore estimates that they are only 2% penetrated among their total customer base.

Only 11.3% of revenue came from outside the United States, which can also represent a significant opportunity for growth.

The TAM estimate also doesn’t include additional products that can digitize other parts of the construction lifecycle. Moreover, 59% of their customers subscribed to 3+ products, and 41% subscribed to 4+ products, which suggests that there is still a lot of headroom to increase ARR per customer.

Financial Numbers

The company has seen a 41% and 40% increase in customers during 2018 and 2019. More impressively, the number of customers that contribute >= $100k of ARR (annual recurring revenue) has grown at a faster rate. (79% in 2018, and 59% in 2019)

The company has grown revenue by 66% in 2018 and 55% in 2019. ( $112.3 million in 2017, $186.4 million in 2018, and $289.2 million in 2019)

63% of revenue growth in 2019 came from existing customers. Revenue growth is mainly driven by customers subscribing to additional products, since ProCore does not charge extra for additional users or projects.

Gross margins have been around 80+% for the past 2 years, and operating margin around (-30%).

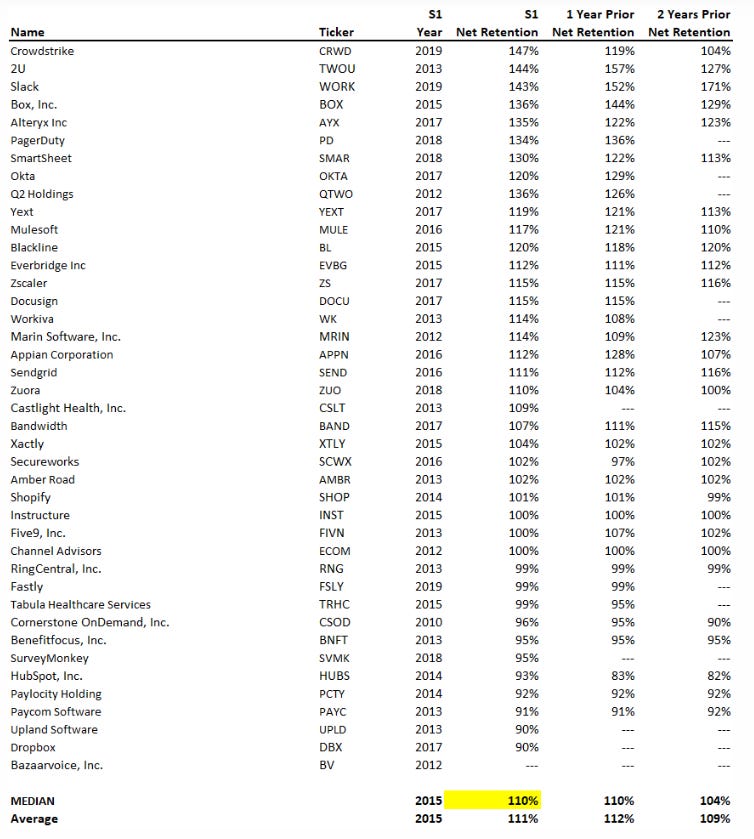

The company has a net rentention rate of 117% in 2019, (125% in 2017 and 121% in 2018) which is above the median of recent SAAS IPOs.

Net retention rate = ARR + upgrades - churn - downgrades.

(The table of comparable net retention rates below is from a 2019 Blossom Ventures post)

SaaS Rule of 40

The rule of 40 is a handy shortcut for evaluating SaaS companies. It’s meant to be a metric that balances growth and profits and serve as a filter to find fast growing companies that are doing it sustainably.

Some good links about the Rule of 40:

Growth rate + profit >= 40

ProCore doesn’t quite meet the Rule of 40, though it was close in 2018.

2018: PCOR (using revenue growth and operating margin): 66% + (-30) = ~36

2019: PCOR (using revenue growth and operating margin): 55% + (-28.6%) = ~27

Valuation

Most SAAS companies are valued on multiples over next twelve months (NTM) revenue.

NTM Revenue Multiples for ProCore

From Meritech Capital’s post:

Verdict

ProCore has a great headstart in an industry that has significant barriers to entry. Moreover, they are making good progress to being the system of record for the construction industry, and has great potential to be a platform company.

While there are some short-term headwinds with a potential economic slowdown (due to the coronavirus), the construction industry will continue to grow, and the company seems poised to grow at 30+% in the coming years ahead.

I am looking to add shares if the company goes down below their target IPO market cap of $4B.